The legal sector has been undergoing transformation for years, but with the arrival of artificial intelligence, a completely new dimension opens up. Tools like zakon.ai are redefining the way lawyers and citizens access legal information. But what does the digital transformation of law actually mean?

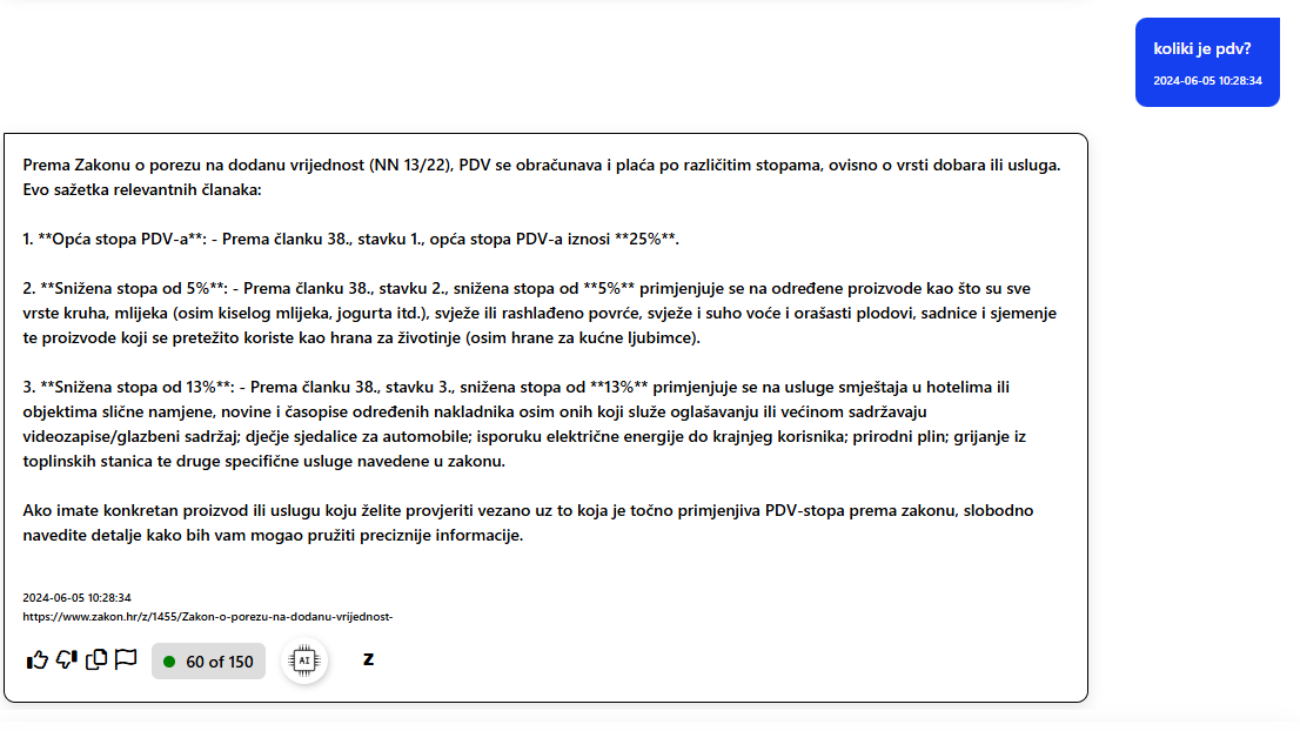

Traditional law search tools often require detailed knowledge of legal terminology and patience to sift through extensive documents. Artificial intelligence makes this process faster and easier. Zakon.ai allows users to ask questions in natural language – for example, “What law regulates Sunday work?” – and get relevant answers in seconds.

This technology not only makes the work of lawyers easier, but also allows citizens and entrepreneurs to quickly access the information they need to make decisions. The future of law is digital, and zakon.ai is already one step ahead, bringing a simpler and more efficient way to work with legal data.